First time homebuyer programs for bad credit

Mortgage rates valid as of 31 Aug 2022 0919 am. These four programs from Fannie Mae andor Freddie Mac are available for first-time home buyers and offer low down payments and low credit score requirements.

First Time Home Buyer Seminar Bic Homes El Paso Tx First Time Home Buyers Home Buying Seminar

Many first-time homebuyer programs grants and down payment assistance programs are available to help you secure the financing you need to purchase your first home.

. As a first time homebuyer I had a lot of questions. FHA loans are a good option for first-time buyers with poor credit or anyone who doesnt have 20 to put toward a down payment. Other common requirements vary by program.

Know where you stand with access to your 3-bureau credit scores and report. What is the 15000 First-Time Homebuyer. GSEs offer multiple conventional loan programs with differing requirements.

Here are a few types of location-based first-time homebuyer programs. North Carolina mortgage rates. Your repayment period depends on the lender.

Minimum credit score for qualified borrowers is 640. First-Time Home Buyer Grants and Programs. A mortgage in itself is not a debt it is the lenders security for a debt.

Down payment assistance grants are typically need-based gift money that doesnt need to be repaid. Your c redit score is just one element that goes into a lenders approval of your mortgage. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance.

8 Best Store Credit Cards for Bad Credit. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan. The First-Time Homebuyer Act of 2021 was introduced by several Democratic members of Congress in April 2021.

Listed below are eight department store cards you might consider. Must be first-time homebuyers. View several other first-time home buyer grants and credits available now.

Learn More about Premier. Look for a credit card offering a deferred-interest promotion. Homebuyer Creators will assist you in selecting the perfect house and analyzing how long ago was the house built as a rent-to-own agreement sometimes require buyers to take care of maintenance costs.

Check out the current status of all of the proposed government programs for first-time home buyers. You must attend a class on home buying and finances. North Carolina first-time homebuyer programs.

As of September 15 2022 the First-Time Homebuyer Tax Credit is still a bill and has not yet been passed into law. 5 for a first-time buyers purchase of a resale existing home. HomebuyerCreators aim to help first-time homebuyers with rent to own homes in Texas.

North Carolina mortgage lenders. How to Buy a House With Bad Credit. 5 or 10 for a first-time buyers purchase of a newly constructed home.

Now that you know the advantages of taking out a department store credit card the next step is choosing the credit card thats right for you. Freddie Mac Home Possible Loans do not have the first-time homebuyer requirement but limit eligibility to borrowers with very low low or moderate income. You must live in the home for a certain number of years often 3.

First-time homebuyer programs can help you better afford becoming a homeowner either with more flexible credit and down payment requirements or a competitively-priced mortgage and down payment. Backed by Fannie Mae this 3 percent down payment mortgage has a. You could have a loan term as short as three months for smaller amounts or up to five years for a larger loan.

Here are some other things lenders look at. This includes several federal state and non-profit programs for first-time home. Take control with a one-stop credit monitoring and identity theft protection solution from Equifax.

Help monitor your credit and Social Security number. Credit card debt drags down your credit score and with it your ability to buy a home or car rent an apartment or sometimes even qualify for a job. Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien.

Homebuyer Down Payment Assistance. No Credit or Bad Credit. 500 homebuyer credit for Chase DreaMaker mortgage applicants who complete a homebuyer education course Rate discounts for select Chase customers 2500 closing guarantee.

ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for. Lets take a look. Federal Housing Administration FHA Loans.

If your credit score is tanking because you cant pay your bills on time its time to take action and. The incentive is available to first-time homebuyers with qualified annual incomes of 120000 or less. What Credit Score Do You Need to Buy a House.

Good credit is a valuable asset and a point of pride but bad credit is an affliction that eats away at those who have it. This bill would bring back the tax credit from 2008 with many of the same requirements. Uncover potential fraud with credit monitoring and alerts.

For example a Fannie Mae 97 LTV Standard Mortgage requires one borrower to be a first-time homebuyer. Homebuyer took the time to get to know me and to address all. Some of these requirements include.

Debt-to-income ratio or DTI is the percentage of your gross monthly income that goes toward paying off debtAgain having less debt in relation to your income makes you less risky to the lender. What is the Current Status. The loan term is equal to the first mortgage and has 0 interest - the loan is repaid when the property is sold no longer the homestead of the homeowners or the loan is refinanced.

Every state in the country has a housing finance agency and all offer special programs for first-time buyers says Anna DeSimone author of Housing Finance 2020. Federal state and non-profit agencies and even mortgage lenders offer grants and loans to support first-time buyers. Down payment assistance DPA can help you buy a home without immediate cash.

The home must be in a specific locale or county. Many programs also consider your debt-to-income ratio. The borrowers must also attend a homebuyer education course.

The best lenders for first-time homebuyers excelled in areas that are historically important for this group including low- to average-credit score requirements low down payment options and. Dont worry as weve got. 5 for a first-time buyers purchase of a new or resale mobilemanufactured home.

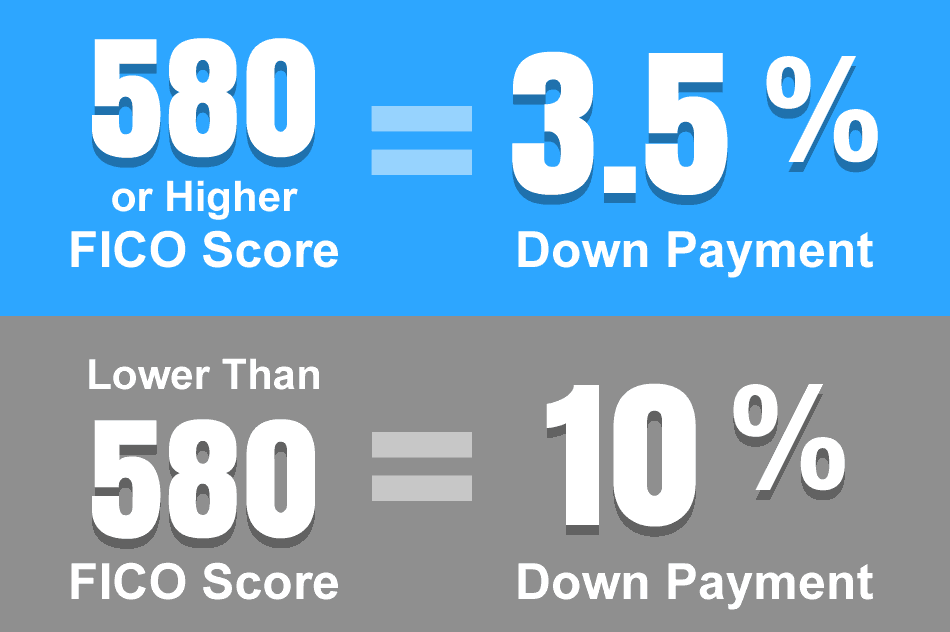

FHA home loans require lower minimum credit scores and down payments than many conventional loans which makes them especially popular with first-time homebuyers. You must be a first-time home buyer. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher.

In fact according to FHAs.

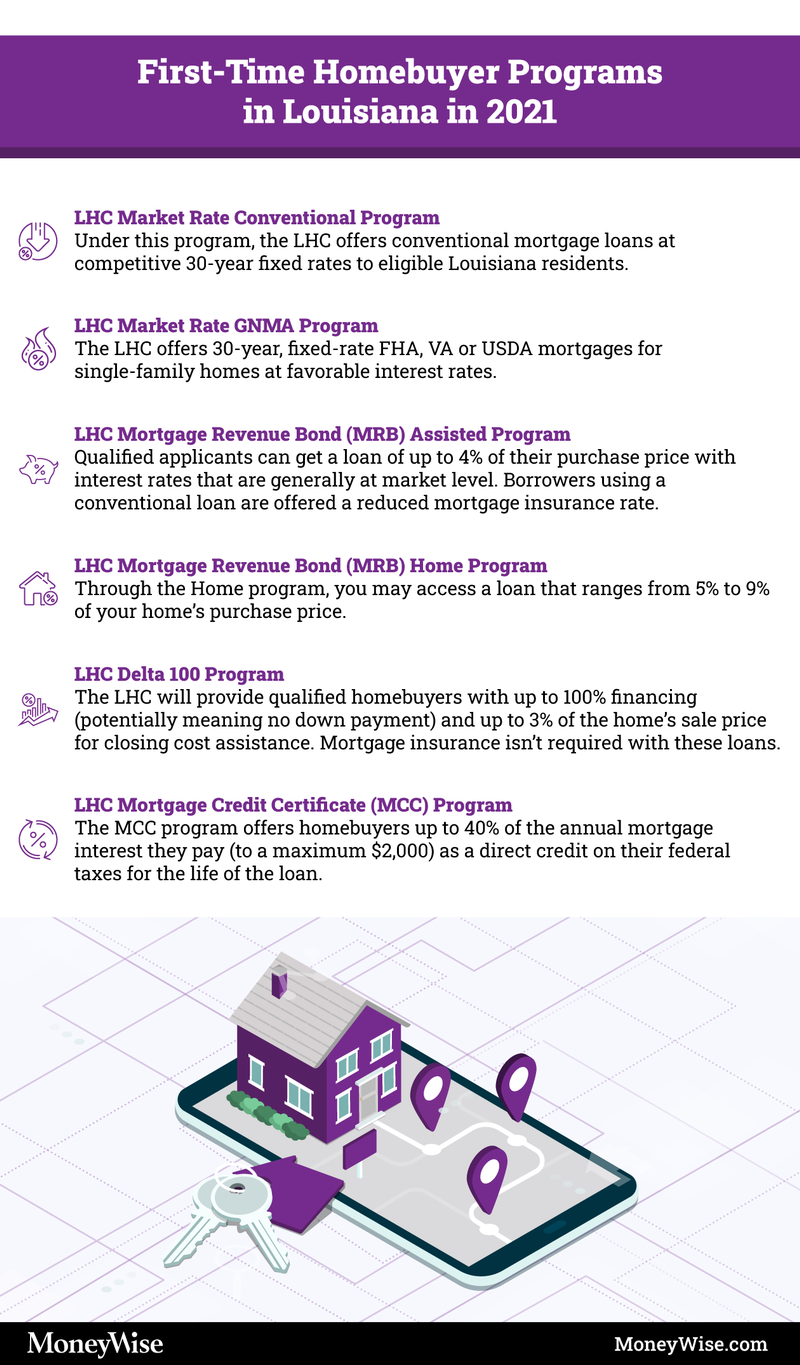

First Time Home Buyer Programs In Louisiana 2022

Credit Score Information For Kentucky Home Buyers Mortgage Loans Good Credit Good Credit Score

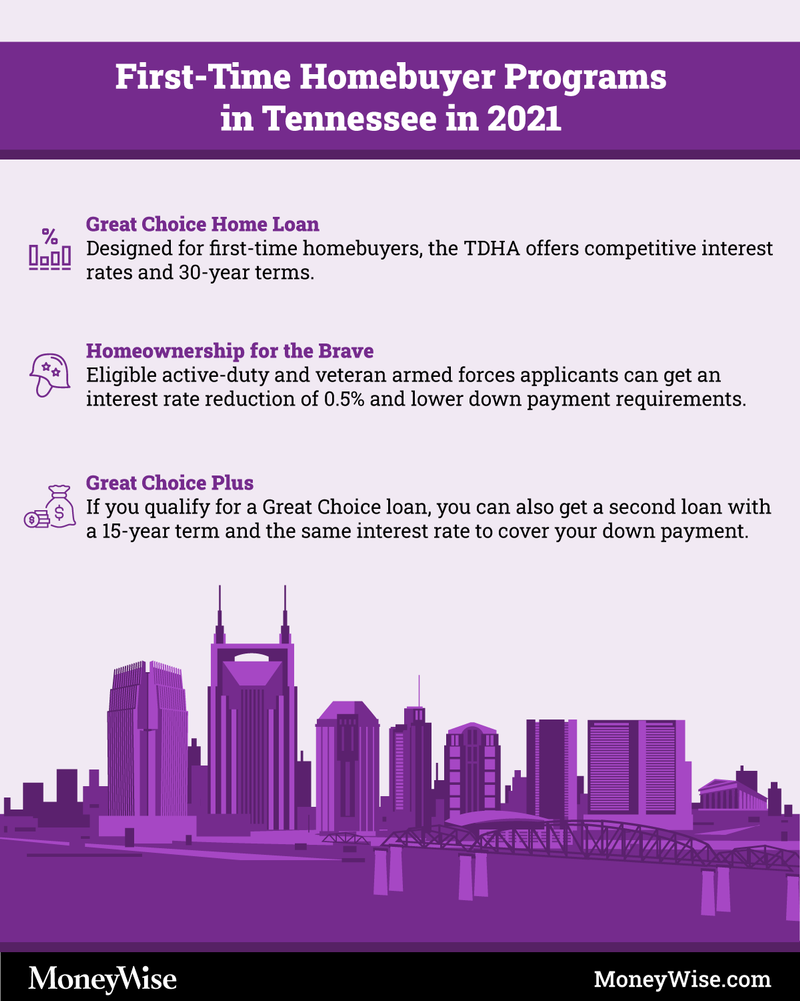

First Time Homebuyer Programs In Tennessee 2022

Home Buyer Tips First Time Home Buyers Buying First Home Home Buying Tips

Kentucky First Time Homebuyer Loan Programs For Fha Va Khc And Usda Mortgage Loans In Kentucky Credit Repair Improve Credit Score Mortgage Loans

Colorado First Time Home Buyer Down Payment Assistance And First Time Home Buyer Programs First Time Home Buyers Buying Your First Home Down Payment

How To Effectively Avoid These 5 Home Buying Mistakes Middleburg Real Estate Atoka Properties Home Buying Buying First Home First Time Home Buyers

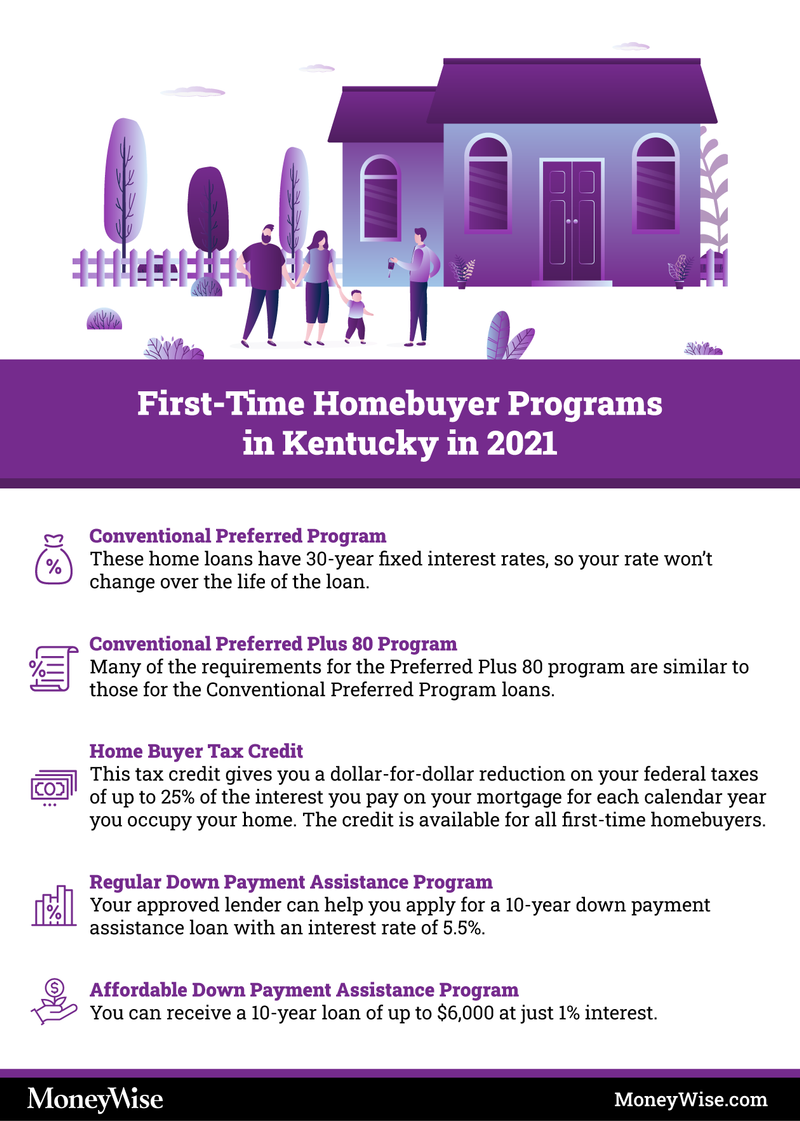

First Time Homebuyer Programs In Kentucky 2022

Find Full Guide On First Time Home Buyer Loans With Bad Credit And Zero Down Payment Different Typ In 2022 First Time Home Buyers Loans For Bad Credit Second Mortgage

Kansas First Time Homebuyer Assistance Programs Bankrate

Ohio First Time Homebuyers Program Guide 2022 How To Get Assistance In Ohio Data Programs Tips Etc

Down Payment Closing Cost Assistance Learn More

4 First Time Homebuyer Helpful Tips Real Estate Agent Marketing Buying Your First Home Home Buying

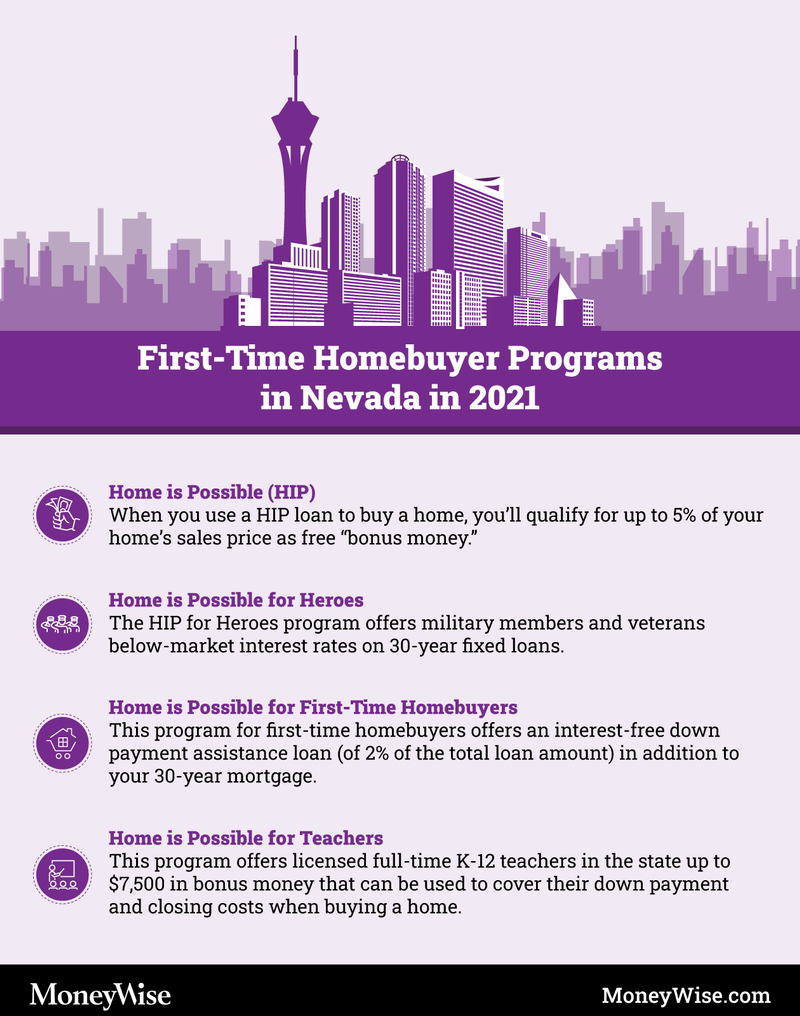

First Time Homebuyer Programs In Nevada 2022

First Time Home Buyer Colorado Programs Down Payment Assistance 2021 Ashford Realty Group

5 Steps To Get A Loan As A First Time Home Buyer With Bad Credit Badcredit Org

Minimum Credit Scores For Fha Loans