Estimated tax payment calculator 2021

Important IRS penalty relief update from August 26 2022. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Quarterly Tax Calculator Calculate Estimated Taxes

Your household income location filing status and number of personal exemptions.

. 1 through March 31 estimated tax is due April 18 2022. The IRS announced that they will be providing Covid tax relief for certain 2019 and 2020 Returns due to the pandemic. Tax Computation Chargeable income before deducting exempt amount.

Estimated 2021 tax 90 percent. For income received April 1 through May 31 estimated tax is due June 15 2022. As a result they will increase your tax refund or reduce your taxes owed.

Terms and conditions may vary and are subject to change without notice. The estimated tax safe harbor rule means that if you paid enough in tax you wont owe the estimated tax penalty. Key Takeaways If you expect to owe more than 1000 in federal taxes for the tax year you may need to make estimated quarterly tax payments using Form 1040-ES or else face a penalty for underpayment.

Use our 2021 tax refund calculator to get your estimated tax refund or an idea of what youll owe. In 2021 the tax credit was up to a 3600 per child under age six and up to 3000 per child age six to 17. Lets say you have a job that pays 20 per hour but after taxes and retirement contributions your take-home pay is only 14 per hour.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. W-2 income. How to pay Online To make your payment online.

If you expect to owe over a certain amount you must make estimated tax payments throughout the year. See TSB-M-1610C Changes to the Mandatory First Installment of Estimated Tax for Corporations for more information. Visit our payment options.

This box is optional but if you had W-2 earnings you can put them in here. Allan and Louise are married and have three children. Use your 2021 tax return as a guide in figuring your 2022 estimated tax but be sure to consider the following.

How Income Taxes Are Calculated. Theyre calendar-year filers who want to know if they should make estimated tax payments in 2021. Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024.

If you expect to earn about the same amount as last year you can take the amount of tax you paid on your 2021 return and divide it by four to figure out your 2022 quarterly estimated tax amount. Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System EFTPS. 2021 Tax Refund Calculator.

For income received June 1 through Aug. Tax Payable 17. Year 20212022 estimated tax.

Certificate of Exemption from Partnership Estimated Tax Paid on Behalf of Corporate Partners this version expires on February 1 2022 IT-2105 Fill-in IT-2105-I Instructions Individuals. The federal income tax deduction allows Missouri taxpayers to deduct federal income taxes paid up to a limit of 5000 for single filers and 10000 for joint filers for tax year 2021. Some taxpayers are required to pay electronically.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Corporate Income Tax Payment.

2022 than you did in 2021 or end up. Use this 1040 tax calculator to help estimate your tax bill for the current tax years rates and rules. Rest assured that our calculations are up to date with 2021 tax brackets and all tax law changes to give you the most accurate estimate.

Restart Enter the following Tax Payment amounts you made during Tax Year 2021. WPRO-10 2021 Estimated Tax Refund. Paying Corporate Income Taxes.

Louis and Kansas City both collect their own earning taxes of 1. Estimated Income Tax Payment Voucher. 100 of the taxes shown on your 2021 Tax Return.

Your total estimated tax can be calculated using the same data from the example above. Ad Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. Individuals can also calculate their underpayment penalty with MassTaxConnects Estimated tax penalty calculator M-2210.

Louise is a teacher. This form has a new mailing address. Use Estimated Tax for Individuals Form 540-ES vouchers to pay your estimated tax by mail.

If you pay 90 or more of your total tax from the current years return or 100 of your tax from the prior year or you owe less than 1000 in tax after withholdings and credits. Redesigned Form W-4P and new Form W-4R. 31 estimated tax is due Sept.

Also gain in-depth knowledge on estate tax and check the latest estate tax rate. Here are the rules. Note that this amount is significantly lower than 2021.

It is beyond the scope of. They use their 2020 federal return and schedules their 2020. How Income Taxes Are Calculated.

Calculate your quarterly payment. Ad Use our tax forgiveness calculator to estimate potential relief available. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

16060 Estimated income tax 14129 Estimated self-employment tax 30189 Total tax. Enter your information for the year and let us do the rest. For income received Jan.

Form number Instructions Form title. Unlike your 1099 income be sure to input your gross wages. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022.

You should submit your quarterly timelines according to the following IRS quarterly estimated tax timeline. Overpayment from your 2020 California income tax return that you applied to your 2021 estimated tax. In addition to the state tax St.

California estimated tax payments made on your behalf by an estate trust or S corporation on Schedule K-1 541 or Schedule K-1 100S. Form W-4P Withholding Certificate for Periodic Pension or Annuity Payments previously titled Withholding Certificate for Pension or Annuity Payments has been redesigned for 2022. To avoid the IRS underpayment penalty you can choose between the following approaches.

Payment you sent with form FTB 3519 Payment for Automatic Extension for Individuals. The IRS will be issuing refunds of up to 12 billion to a total of 16 million qualifying individual taxpayers Form 1040 and businesses Form 1120 who filed their 2019 or 2020 taxes late. The Basic Tax.

Residents and anyone who works in either city must pay this tax. No More Guessing On Your Tax Refund. 7500 Next 26000 50 13000 Chargeable income after deducting exempt amount.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. In other words you can use your exact figure from your previous year return or you can estimate within 10 of your anticipated 2022 tax balance. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Club ABC has chargeable income of 36000 for YA 2021. An estate is the estimated net worth of a person which typically consists of their assets less any liabilities. Your household income location filing status and number of personal exemptions.

A list of estimated tax payment options. Use the worksheet found in Form 1040-ES Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax. Your refund has been.

If you use this method but end up earning more money in. If your federal income tax withholding plus any timely estimated taxes you paid amounts to at least 90 percent of the total tax that you will owe for this tax. Mail Franchise Tax Board PO Box 942867 Sacramento CA 94267-0008.

Free estate tax calculator to estimate federal estate tax in the US. Meaning your pay before taxes and other payroll deductions are taken out. If this is your first year.

Tax Calculator 2021 Tax Returns Refunds During 2022. Payments due April 15 June 15 September 15 2021 and January 18 2022. Here are the rules.

For the 2021 tax year estimated quarterly payments are due. CT-300-I Instructions Mandatory First Installment MFI of Estimated Tax for Corporations. Either actual or estimated amount here.

Before making an Income quarterly estimated payment calculate online with the Quarterly Estimated Tax Calculator. Estimate Today With The TurboTax Free Calculator.

Quarterly Tax Calculator Calculate Estimated Taxes

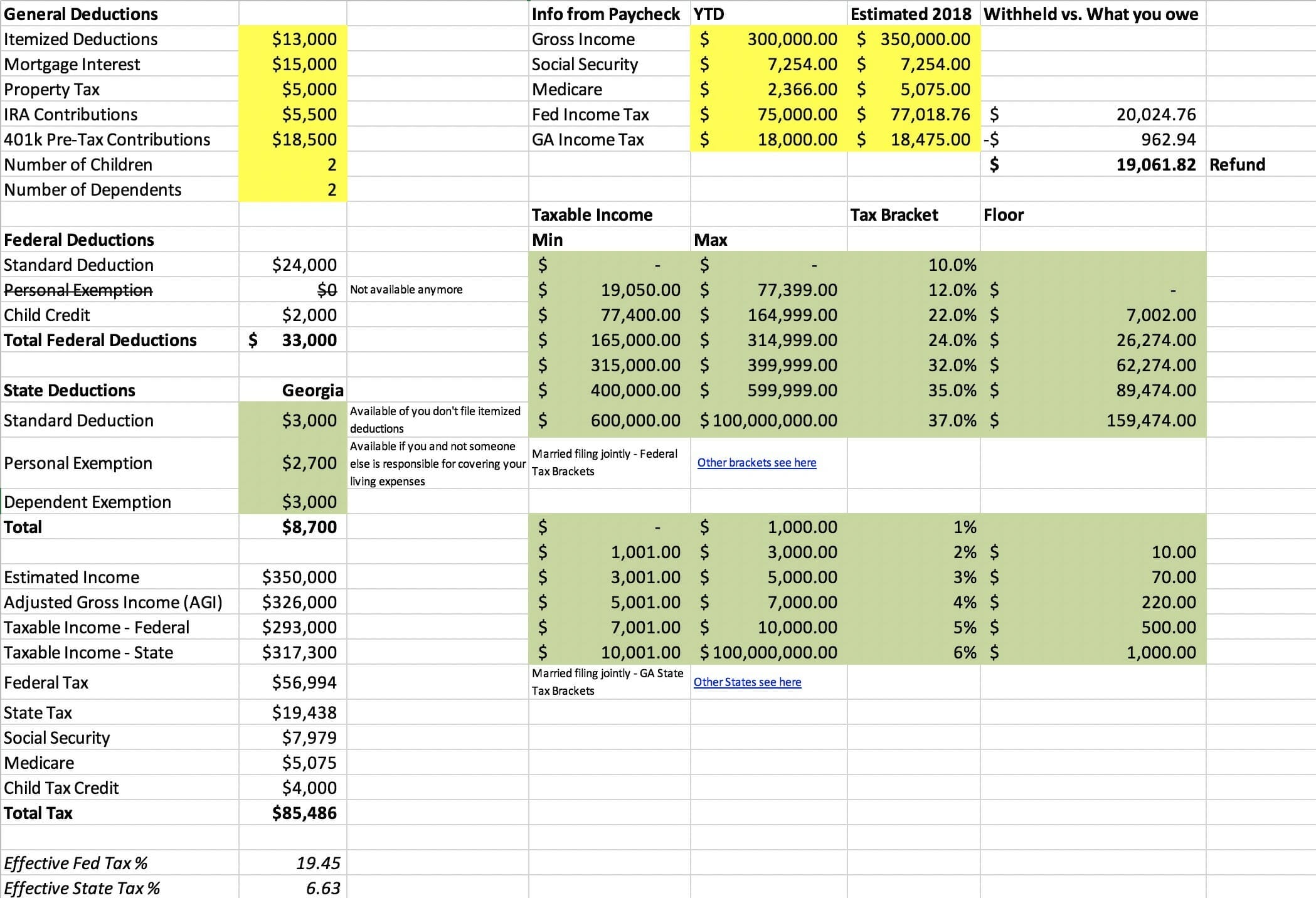

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Quarterly Tax Calculator Calculate Estimated Taxes

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Estimate Your Paycheck Withholdings With Turbotax S Free W 4 Withholding Calculator Simply Enter Your Tax Information And Adjust Y Turbotax Tax Refund Payroll

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Tax Calculator Estimate Your Income Tax For 2022 Free

Taxcaster Free Tax Calculator Estimate Your Tax Refund Turbotax Tax Refund Turbotax Tax

Tax Year 2022 Calculator Estimate Your Refund And Taxes

Estimated Income Tax Payments For 2022 And 2023 Pay Online

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

Faqs On Penalty For Underpayment Of Estimated Tax Https Www Irstaxapp Com Faqs On Penalty For Underpayment Of Estimated Tax Tax Tax Deductions Coding

Tax Calculator Refund Return Estimator 2021 2022 Turbotax Official

Click Here To View The Tax Calculations Income Tax Income Online Taxes

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Quarterly Tax Calculator Calculate Estimated Taxes

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax